The insurance industry is evolving at a breakneck pace, and to keep up with the competition, insurance companies are adopting innovative strategies to boost customer retention and drive policy renewals. One of the most exciting new tactics is the integration of gamification in insurance. This means insurance providers implement exciting game-like features, such as challenges and rewards, into their services. By doing so, they’re changing what has traditionally been a mundane process into an engaging and enjoyable customer experience.

As competition grows and customer expectations rise, insurers realize the importance of connecting deeply with their customers. And what better way to do this than through gamification? In this article, we explore the power of gamification in insurance and how it shapes customer behavior, driving loyalty and increasing renewals.

What is Gamification in the Insurance Industry?

Gamification incorporates game-like elements into non-game settings to enhance user engagement and enjoyment. In the insurance industry, gamification can take the form of interactive features designed to make customer interactions more compelling. This can include activities such as games of chance or structured challenges based on individual user behaviors and requirements.

Gamification in insurance could involve creating interactive apps or online platforms that incentivize customers to engage with their insurance policies, such as by earning rewards for safe driving habits or completing educational modules about their coverage. This can increase customer engagement and provide valuable data for risk assessment and management.

The Significance of Customer Engagement in Insurance

If there’s one thing that insurance companies can’t afford to ignore, it’s customer engagement. Not only does it ensure that customers remain satisfied, but it also helps to foster long-lasting relationships that build loyalty and drive business growth. After all, when customers are engaged with their insurance provider, they’re more likely to renew their policies and spread the word about their positive experiences to others. This creates a cycle of expansion for insurance companies, leading to even greater success in the long run.

Engagement goes beyond satisfaction – it includes creating meaningful connections that make customers feel valued and understood. When customers have a sense of belonging and trust in their insurance provider, they are more likely to remain loyal, which in turn boosts revenue and overall company success.

Personalization plays a crucial role in the insurance industry. Insurance companies need to make their customers feel valued and not just like a number. By personalizing their approach, insurance companies can effectively engage with their customers. Analyzing customer data allows insurance companies to gain insights into each individual’s preferences and needs, enabling them to tailor their products and services to deliver personalized and relevant experiences.

Moreover, maintaining strong customer relationships in the insurance industry depends on effective communication. This means providing timely and relevant information to keep customers informed and engaged. By proactively addressing any questions or concerns, insurance companies can reinforce trust and ensure that customers feel supported throughout their journey with the company. This attentiveness enhances customer satisfaction and positions the company as a trustworthy partner in safeguarding their clients’ interests.

Five Ways Gamification Improves Business

- Increases Customer Engagement: Gamification makes insurance-related activities more interactive and enjoyable. Customers can earn rewards or unlock achievements by completing tasks or meeting certain milestones.

- Enhances Education and Understanding: Gamification can help demystify insurance concepts and policies through interactive learning tools and games. This helps customers better understand their coverage options and responsibilities, making them more informed and confident in their decisions.

- Boosts Employee Performance: Gamified tasks can motivate insurance agents or sales teams to achieve targets and compete with each other. Rewards or recognition for meeting sales goals incentivize and encourage higher productivity.

- Collect Valuable Data: By engaging customers in gamified activities, insurers can gather important user behavior and preferences data. This data can be analyzed to refine marketing strategies, improve product offerings, and personalize customer experiences.

- Improves Customer Loyalty and Retention: Through incentives, discounts, or exclusive offers, gamification encourages loyal customers to stick with their policies and maintain long-term relationships with the insurance company.

How BeeLiked Helps Insurance Companies Boost Loyalty and Renewals

Maintaining customer loyalty and encouraging policy renewals are vital for long-term success in the insurance industry. Using gamification can significantly enhance these aspects. BeeLiked’s solutions allow insurers to implement various gamification strategies without relying on traditional point systems or leaderboards. Here’s how insurers can use BeeLiked’s services to foster loyalty and promote renewals:

1. Reward Consistency

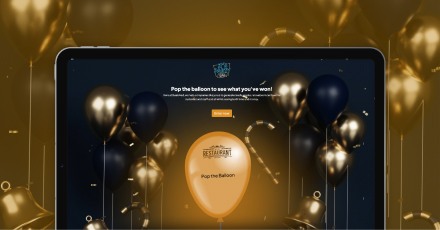

Encourage consistent behavior, such as timely premium payments or continuous policy renewal, by allowing customers to unlock special game entries. For example, after a certain number of consecutive timely payments, invite customers to an exclusive game of Spin-the-Wheel. Each wheel segment could offer different rewards, increasing in value based on the consistency of the customer’s payments. We simplify the process of incorporating automated promotions into current systems and applications for developers. Our secure one-time InviteLink technology allows for personalization by encoding user data.

2. Anniversary Celebrations

Mark a customer’s policy anniversary with a special game of chance to celebrate their loyalty. This could include a unique yearly game where long-term customers can win exceptional rewards. For example, for each policy anniversary, customers can play a special Slot Machine game designed exclusively for the special occasion. The slots could feature symbols representing different aspects of the customer’s relationship with the insurer, such as years of loyalty, types of coverage, and more. Winning combinations could result in various prizes like upgrades in coverage, exclusive discounts, or special one-time rewards.

3. Seasonal and Promotional Campaigns

Run seasonal games that align with major holidays or company milestones. These can be excellent opportunities to engage customers and remind them of the benefits of staying with their current insurer. Promotional campaigns can also be timed with renewal periods to boost engagement and renewals simultaneously.

Our interactive Advent Calendar is perfect for this! Customers can open a new window daily during the festive season, like a Christmas or New Year countdown. Each window can reveal a different prize or offer, such as discounts on the next year’s premium, complimentary add-ons, or exclusive content related to insurance education and wellness tips. This game is fantastic for driving daily engagement and building anticipation and excitement, keeping customers connected with the insurer throughout the holiday season.

4. Exclusive Access Games

Offer certain games only to customers who meet specific criteria, such as having multiple policies with the insurer or being a customer for a certain number of years. This exclusivity adds a layer of prestige and incentivizes customers to maintain their policies. Our digital Scratch and Match is an exciting game to offer VIP clients. The scratch card can be themed around elements that resonate with the VIP status, featuring symbols like gold bars, diamonds, or platinum cards. You can make the prize as exclusive as you’d like.

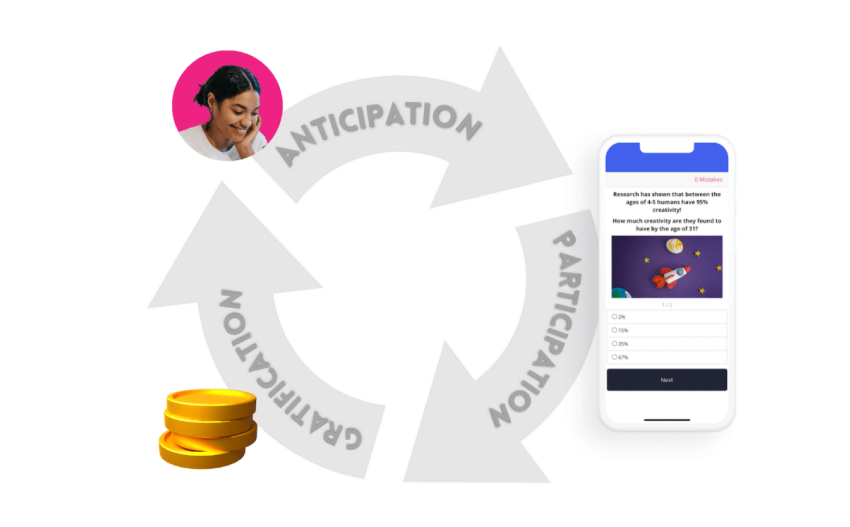

5. Engagement Through Anticipation

Build anticipation with ongoing, serialized games revealing outcomes over time. This keeps customers engaged with the insurer’s platform, increasing touchpoints and reinforcing loyalty. For example, you can create a serialized Mystery Box game where customers receive clues or tokens to unlock a box over a period (e.g., monthly). Each box could contain different surprises, maintaining interest and engagement over time, and culminating in a final grand prize at the end of the year.

Drive Loyalty and Renewals With Gamified Insurance!

With the rapid changes in the insurance industry, providers must adapt and innovate to meet the demands of their customers. Gamification in insurance is one of the best and most exciting new tactics for enhancing customer experiences and encouraging loyalty and retention. With the ability to personalize experiences through gamification, insurers can take customer interactions to the next level, creating meaningful connections that build trust and loyalty.

With BeeLiked’s customizable solutions, insurers can create engaging game-like experiences that resonate with their customers, boosting satisfaction, loyalty, and revenue. Whether you want to motivate sales teams, educate customers, or increase engagement, BeeLiked has all the tools you need to get started. So why wait? Take the first step towards improving your business today.