The insurance industry is a dynamic and data-powered sector where evaluating risks and effectively managing them is absolutely essential for achieving success and ensuring the long-term viability of the business. Thanks to technological advancements, insurance companies are constantly exploring groundbreaking methods to enhance these core processes and deliver superior results.

One trend creating buzz in various industries is gamification, and insurers have taken note. Why are insurers jumping on board? They’re aiming to motivate policyholders to practice safer behaviors while also boosting engagement by making the insurance process more fun and user-friendly. In this article, we’ll delve into the advantages of gamification in risk assessment and management. Some potential benefits include heightened customer loyalty, better risk mitigation, and fewer claims.

What is Gamification?

Incorporating game elements and mechanics into non-game contexts to enhance user engagement, motivation, and learning is known as gamification. Fun and interactive strategies are used to encourage users to complete tasks, achieve goals, and acquire new knowledge or skills. Creating a sense of autonomy, difficulty, and progress through challenges, rewards, and social connections is key to achieving this. Gamification techniques can be applied across various fields, including education, healthcare, marketing, and customer engagement, to enhance user experience and drive desired behaviors.

In insurance, gamification can improve risk assessment and management by motivating users to identify and mitigate potential risks. Take a game like Mystery Box, for example, each employee can be presented with a virtual box containing a potential risk scenario. The employee must then use their knowledge and expertise to identify the risks associated with the scenario and create a plan to mitigate them. The employee earns points for correctly identifying and mitigating risks and can compete with other employees to earn the highest score. Using competition and reward to gamify risk assessment and management makes employees more engaged and driven with their work.

Understanding Gamification in Risk Management

Gamification in risk management employs various game mechanics, such as feedback loops, progress indicators, ]challenges, and rewards to motivate and engage users. Incorporating these mechanics can transform tedious tasks like data entry or compliance training into more captivating activities, improving accuracy and user engagement.

- Feedback Loops: Continuous feedback helps users understand their progress, correct mistakes, and stay motivated.

- Progress Indicators: Visual representations of progress, such as completion bars or achievement badges, provide a sense of accomplishment and encourage further effort.

- Challenges: Introducing challenges or levels makes tasks more engaging by providing goals and milestones to strive for.

- Rewards: Offering rewards, such as points, badges, or even tangible incentives, enhances motivation and satisfaction.

Recent studies have shown that gamification can significantly boost employee engagement and productivity in the workplace. For instance, research highlighted by TechReport indicates that gamification can lead to an improvement in employee engagement by over 48%. This is primarily because transforming mundane tasks into more stimulating challenges boosts productivity and also reduces workplace stress.

Five Benefits of Gamification in Risk Assessment and Management

1. Improved Risk Management Practices

Gamification can significantly enhance overall risk management practices by promoting proactive behaviors and increasing awareness. For instance, a gamified system that tracks and rewards safe workplace behaviors can lead to a reduction in accidents and incidents. Similarly, engaging employees in simulated risk scenarios can improve their response strategies and decision-making skills. This proactive approach helps in reducing the occurrence of incidents and aids in developing more accurate risk profiles. By making risk management an integral part of the organizational culture through gamification, companies can create a safer and more resilient work environment.

2. Behavioral Incentives

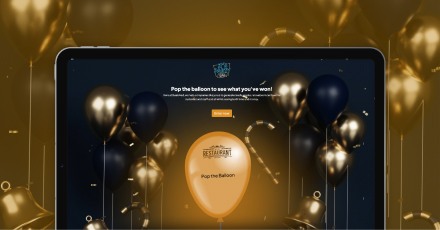

Gamification offers behavioral incentives by tapping into our natural competitive instincts and desire for recognition. In risk assessment and management, organizations can use gamified elements to encourage desired behaviors. For instance, insurers might use a game like Spin-The-Wheel to offer policyholders the chance to win exciting prizes if they take actions that align with your organization’s goals and values. For example, you could offer rewards for completing health check-ups, meeting fitness goals, or reducing their carbon footprint. The game’s element of chance adds excitement to the process, making it more likely that policyholders will participate and take actions that they otherwise wouldn’t.

3. Predictive Analytics

Gamification tools can collect vast amounts of data through their interactions with users. When processed, this data can offer detailed insights into potential risks before they materialize. By analyzing patterns in the data collected from gamified interactions, risk managers can predict outcomes more accurately and make informed decisions. This data-driven approach helps in assessing risk, identifying emerging threats, and developing strategies to mitigate them effectively.

BeeLiked’s solutions provide businesses with relevant insights for making informed decisions. With BeeLiked, risk managers can create gamified experiences that collect data on user behavior. This enables insurers to make data-driven decisions when assessing risk and pricing policies.

4. Enhanced Training Modules

Gamification can support ongoing professional development in a dynamic industry like insurance, where regulations and products frequently change. In risk management, where regulations and best practices frequently change, gamified training ensures that the workforce stays up-to-date with the latest standards. This approach helps employees better understand and retain information, leading to improved compliance and more effective risk management practices.

5. Increased Engagement and Collaboration

Gamification can boost engagement and collaboration among employees in risk management tasks. By introducing challenges and team-based activities, organizations can make the process of assessing and managing risks more interactive and enjoyable. This increased engagement leads to higher participation rates and better collaboration, as employees are motivated to work together to achieve common goals. Enhanced engagement also means that employees are more likely to take ownership of risk management initiatives, leading to a more proactive and vigilant approach to identifying and mitigating risks.

How BeeLiked Helps Insurers With Effective Gamification

As the insurance industry continues to evolve, the integration of gamification into risk management represents a promising frontier. BeeLiked provides cutting-edge gamification solutions that seamlessly integrate into insurance companies’ existing workflows. Here’s how we can help:

- Our software is designed to be incredibly intuitive and adaptable, making it the perfect solution for insurance companies looking to integrate gamification strategies without any hassle.

- Insurance companies can revolutionize the work environment by introducing customizable games and performance tracking. This creates an engaging and tailored experience for their workforce!

- BeeLiked transforms risk management with engaging, data-driven processes, empowering insurers to enhance operations and cultivate a proactive risk management culture!

BeeLiked’s gamification software has the power to revolutionize how insurers evaluate, handle, and reduce risks. By harnessing the potential of gamification, insurers can elevate their risk management techniques and deliver higher customer satisfaction and loyalty. The result is a win-win for both insurers and their clients! Don’t miss out – start your journey with BeeLiked today!